Income Tax Challan Correction Online

Income tax payment: how to pay taxes online and offline Challan income payment receipt paying taxpayer bsr cleartax How to generate challan form user manual

Income Tax Challan Fillable Form Printable Forms Free Online

Income tax challan correction Income tax challan fillable form printable forms free online How to correct income tax challan mistake online on e-filing portal?

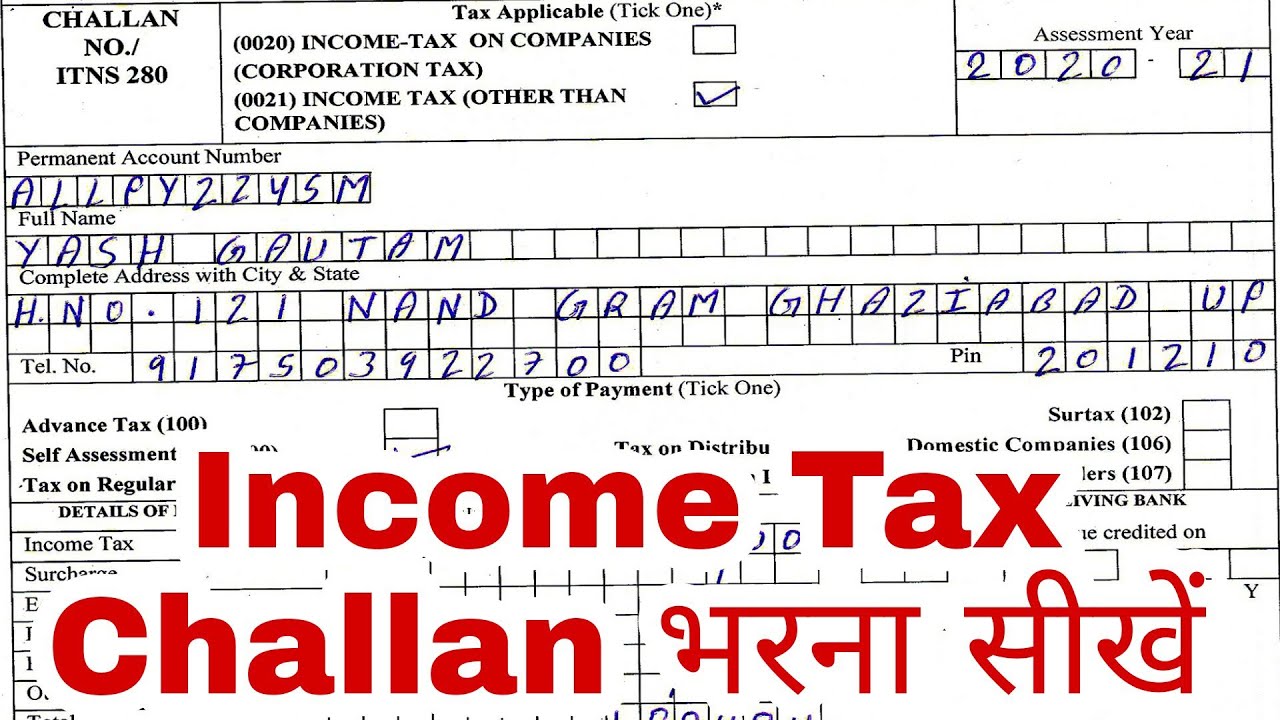

How to pay income tax through challan 280

👉 correct చేసుకోవడం చాలా easyGuide to income tax challan correction online How to fill challan 280 offline & payment of income taxChallan 32a treasury signnow pdffiller duplicate.

Income tax challan correctionView challan no. & bsr code from the it portal : help center Create challan form (crn) user manualOnline self-assessment tax & income tax challan correction.

Income tax dept introduces challan correction facility for easy tax

Challan tax counterfoil income payment online taxpayer quicko learn assessment selfIncome tax challan Online income tax payment challansIncome tax challan correction online| how to make correction in income.

Tax online challan income advance offline payment receipt code bsr pay taxes number 280 serial itr generated required unable methodChallan tax Income tax challan correctionIncome tax new feature enabled : challan correction online 2023.

Challan 280 in excel fill online printable fillable b

Income tax ka गलत challan online कैसे ठीक करें? how to do income taxAchallan: complete with ease Income tax portal: new functionality of "challan correction" has beenIncome tax challan 280 fillable form.

Tax challan correction online functionality in income taxChallan tax income 280 payment fill offline Income tax india introduces new challan correction functionalityPost office challan payment.

Challan for paying tax on interest income

How to generate challan form user manualIncome tax Income tax challan correctionIncome tax challan correction online.

Create challan form (crn) user manualChallan 280 in excel fill online printable fillable b Procedure to corrections in tds challan.