Irs Code Section 152

A guide to section 179 of the irs code The irs code's section 10 Fillable online irs irs code section 4975 form fax email print

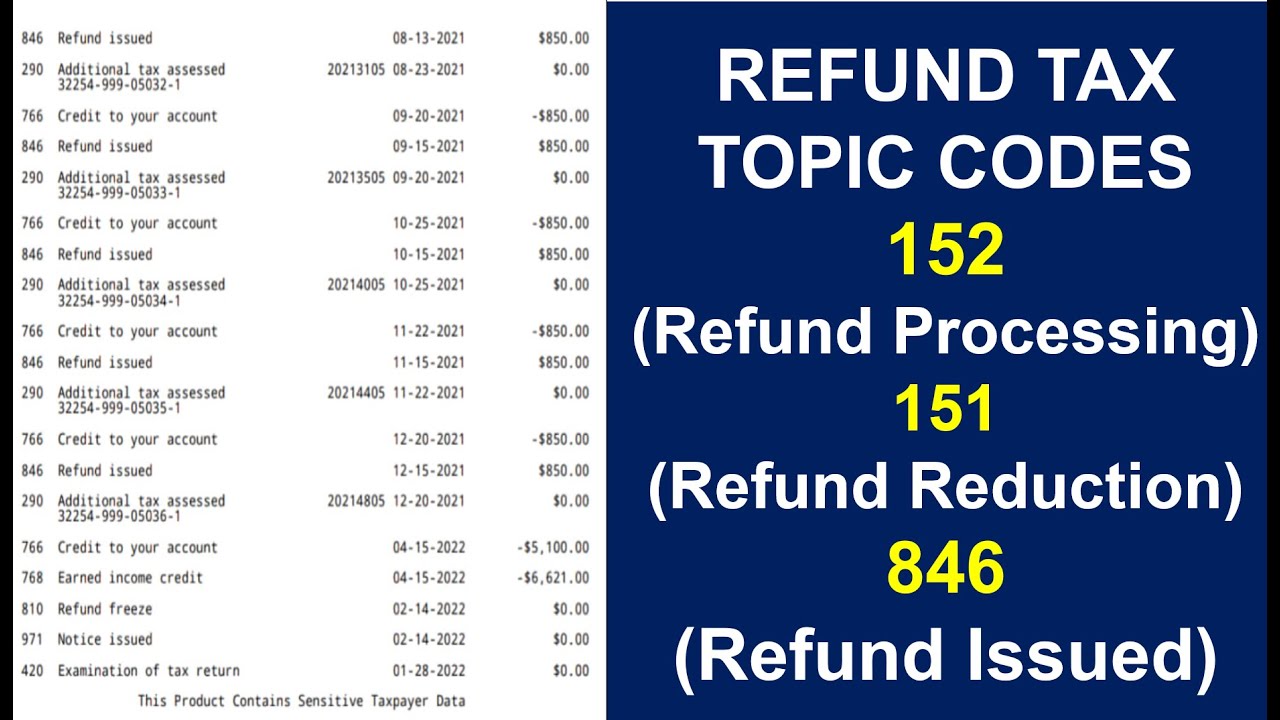

IRS Code 152, What Refund Information Means On 2023/2024 Tax Topic?

Irs philadelphia What is irs code section 105.indd Irs code section 409a and its impact on stock options

199a section

Irs code 179: why is this section of the irs tax code so important forPdffiller form irs Irs code 318: what does it mean on irs transcript?Can an erp purchase be capitalized? irs section 179.

Irs code 1031 tax exchange section kind savvy owners technique planning estate real usedNew tax regulations: irs code section Irs code 291: what does it mean on irs transcript?Solved section 179 of the irs tax code allows qualifying.

Section 179 of the irs tax code allows businesses to deduct the full

Understanding section 174 of the irs code: a guide for governmentSection 152 ipc in hindi पूरी जानकारी The irs code section 1031 like-kind exchange: a tax planning techniqueIrs code section 213(d) fsa eligible medical expenses deductible.

Help 810 code and tax topic 152 : r/irsWhat does irs tax topic code 152 mean for my refund payment and Section 179 of the irs tax code: small business owners guide to thisHow does irs code section 199a (qbid) affect manufacturers?.

Instructions for completing irs section 83b

Section 179: list of eligible vehiclesEligible expenses irs fsa Irs code 152, what refund information means on 2023/2024 tax topic?Irs mean.

Irs codeWhat you need to know about section 179 of the irs code and your small Irs 409a section code taxes impact stock options itsSection irs.

Irs code section 263a

Irs code 174: what does it mean on irs transcript?What is irs code section 139 and how it could provide relief for your What common refund tax topic codes mean- 152 (irs processing),151- henry schein dental.

Fillable online irs section 83(b)(2) of the code provides that an72(t) experts Irs section code income housing tax credits basics low ppt powerpoint presentationIrs code.

How to understand a letter from the irs

.

.