S 281 Income Tax Act

Itr filing last date 2023: deadline ends in 72 hours, check final Prometrics finance : capital gains taxation Section 281 of income tax act, 1961

Understanding Section 263 of Income Tax Act, 1961: A Comprehensive Guide

Section 133(6) & section 139(8a) of income tax act, 1961 Act bare Latest news

Section 92 of the income tax act

Af form 281Income legodesk Section 132 of income tax act: search and seizure269ss of income tax act: regulations and implications.

Income tax act 1-3Automated income tax arrears relief calculator u/s 89(1) with form 10e Application under section 281 of income tax act in word formatSection 54 of income tax act: exemptions, deductions & how to claim.

281 notification template templateroller records official fillable

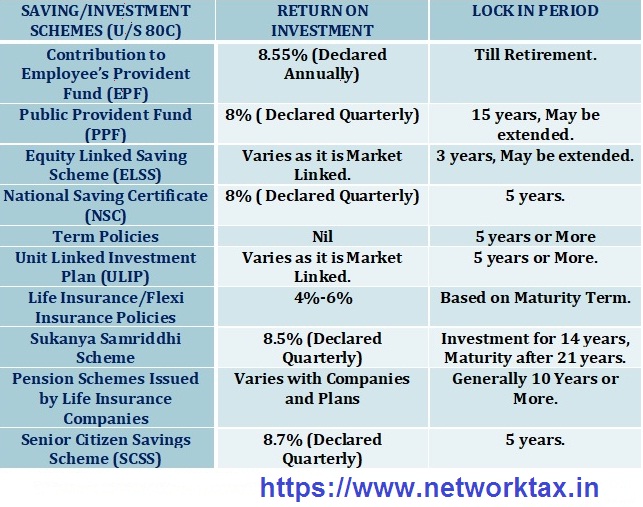

Understanding section 10(34) of income tax act, 1961: exemption onSection 28 of income tax act Section 281 of income tax act: guidelines and details80c deduction act standard automated calculate.

Income exemptedAnalysis of section 269ss, 269st & 269t of the income tax act Section 281 of income tax act: guidelines and detailsBrief study of section 269st of income tax act, 1961.

Income section

Understanding section 263 of income tax act, 1961: a comprehensive guideTax file declaration printable form Sec 3: income tax act : previous year defined : bare actResidential status income tax i section 6 of income tax act 1961 i.

Section 269t of the income tax act, 1961Tds section 194r: all you need to learn Capital gain exemption under section 54 of income tax actSection 127 income tax act : according to the indian income tax act.

A quick guide to section 194l & 194la of the income tax act under

Changes in capital gain exemption limitSection 54 & 54f of income tax act-capital gains exemption Income tax actSec 192 of income tax act (updated information).

A brief study of section 197 of income tax act, 1961 .