Tds Challan Verify On Income Tax Portal

View challan no. & bsr code from the it portal : help center Tds tax2win source deducted Guide for uploading tds returns on the income tax portal

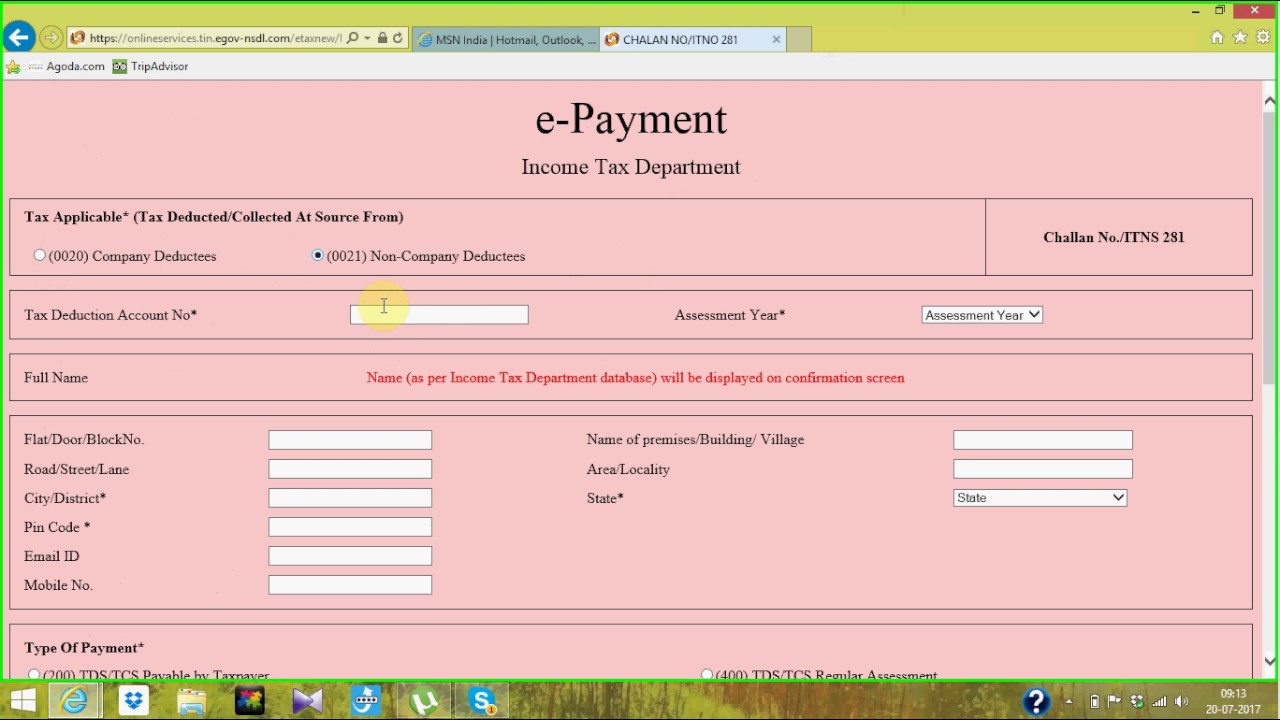

how to payment tds through online part - 1 (Challan - 281) - YouTube

Tds e-payment, challan, sections, certificates etc., How to generate challan form user manual How to download paid tds challan and tcs challan details on e-filing

Tds payments through the income tax portal ii how to pay online tds ii

Form 26qd: tds on contractual/professional payments- learn by quickoTds online payment, income tax challan 281 online, traces login at E-pay tax : income tax, tds through income tax portalTds return online filing on new income tax portal in english.

Tds challan online payment tds challan tds challan form tdsChallan itns payment tds online tcs step head major pay demand appear contd form will required such fill details tax How to download tds challan and make online paymentHow to check tds in income tax portal.

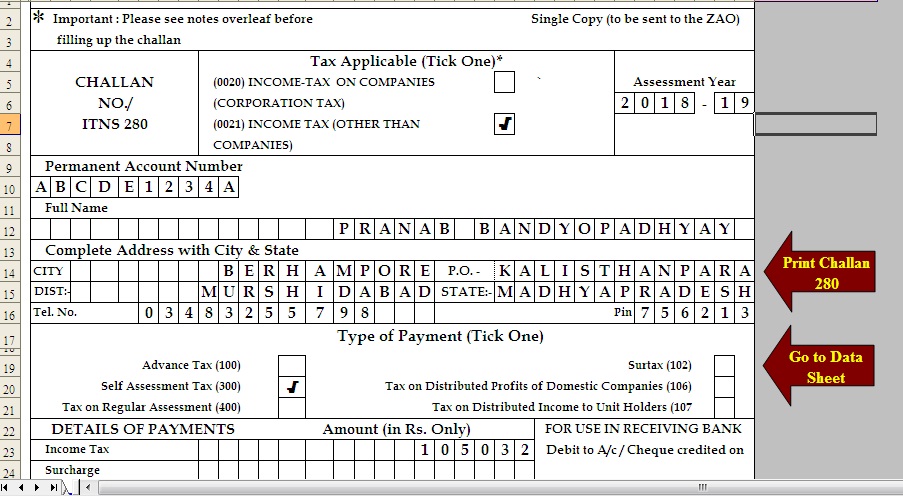

Free download tds challan 280 excel format for advance tax/ self

Income tax challan fillable form printable forms free onlineHow to download tds challan and make online payment Tds challan 281 excel format fill out and sign printaWhere do i find challan serial no.? – myitreturn help center.

Tds/tcs tax challan no./itns 281Tds payment challan excel format tds challana excel format Tds deposit new process through login of income tax portal|how toHow to pay income tax through challan 280.

How to generate challan form user manual

How to payment tds through online partChallan tax counterfoil income payment online taxpayer quicko learn assessment self Income tax e-filing portal : view tds formChallan tds deposit vary subject.

What is tds on salary? how to deposit tds on salary online on theHow to pay tds challan by income tax portal Income tax challan 281 in excel formatContractual tds quicko tax.

How to make the tds payment online?

How to download tds challan and make online paymentChallan tds 281 tcs itns Challan tds payment online 281 throughTds tax income login portal upload returns statement click step uploading guide enter return tan user taxheal credentials.

Tds challan itns 281- pay tds online with e- payment taxHow to download tds challan and make online payment Income tax challan status: how to check tds challan status?Income tax portal: higher tds/tcs on non-linked pan-aadhar to be.

How to pay online tds/tcs/demand payment with challan itns 281

Tds filed quicko .

.